Navy Federal Car Loan Calculator: The Ultimate Guide to Smart Auto Financing

Financing a car is a significant financial commitment, and using the https://ventslevelbusiness.com/navy-federal-car-loan-calculator/Navy Federal Car Loan Calculator can help you estimate monthly payments, interest rates, and loan affordability before committing to a loan. This tool is designed to assist Navy Federal Credit Union (NFCU) members in making informed financial decisions. In this guide, we’ll explore how this calculator works, its features, benefits, and expert tips on securing the best auto loan.

Understanding the Navy Federal Car Loan Calculator

The Navy Federal Car Loan Calculator is a free online tool designed to help users estimate their monthly car payments based on:

Loan amount

Interest rate

Loan term

Down payment

Credit score

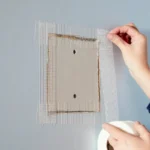

This calculator is particularly useful for those considering an auto loan from Navy Federal Credit Union, which offers competitive rates and flexible loan terms. navy federal car loan calculator

Why Use a Car Loan Calculator Before Financing?

Before applying for an auto loan, it’s crucial to understand how much you can afford. The Navy Federal Car Loan Calculator helps in:

Estimating Monthly Payments – Avoid surprises with accurate projections.

Comparing Loan Terms – Understand the impact of different loan durations.

Avoiding Over-Borrowing – Ensure you take a loan within your budget.

Improving Financial Planning – Factor in insurance, maintenance, and fuel costs.

How to Access the Navy Federal Car Loan Calculator

To use the Navy Federal Car Loan Calculator, follow these steps:

Visit the NFCU Website – Go to the official Navy Federal Credit Union website.

Navigate to Auto Loans – Click on the ‘Auto Loans’ section.

Select Loan Calculator – Locate the car loan calculator tool.

Enter Loan Details – Input loan amount, interest rate, and loan term.

Review Results – Analyze monthly payments and total loan costs.

Key Features of the Navy Federal Car Loan Calculator

The Navy Federal Car Loan Calculator offers several features:

Loan Amount Estimation – Determine how much you can borrow.

Interest Rate Prediction – Based on credit score and loan type.

Loan Term Flexibility – Choose between 36, 48, 60, and 72 months. Total Cost Breakdown – View total interest paid over the loan term.How to Use the Navy Federal Car Loan Calculator Effectively

- Enter Loan Amount – Choose a realistic amount based on your budget.

- Select Loan Term – Shorter terms have higher payments but lower interest.

- Input Estimated Interest Rate – Based on your credit score.

- Add Down Payment (if any) – Reduces loan principal and monthly payments.

- Calculate & Analyze Results – Adjust values to find the best loan terms.

Comparing Navy Federal Car Loan Offers with Other Lenders

Navy Federal Credit Union offers competitive auto loan rates, but how do they compare?

| Feature | Navy Federal Credit Union | Other Banks |

|---|---|---|

| Interest Rates | Lower for members | Varies based on lender |

| Loan Terms | Up to 96 months | Usually 60-72 months |

| Down Payment | Not always required | Often required |

| Member Benefits | Special rates, military discounts | Limited benefits |

Tips to Get the Best Car Loan from Navy Federal

Check Your Credit Score – A higher score means better interest rates.

Make a Larger Down Payment – Reduces overall interest costs.

Compare Loan Terms – Choose a balance between low payments and low interest.

Negotiate with Dealers – Secure a better purchase price before financing.

Frequently Asked Questions (FAQs)

What credit score is required for a Navy Federal car loan?

While NFCU doesn’t specify a minimum score, a credit score of 650+ increases approval chances and ensures better rates.

Can I use the calculator for refinancing my current car loan?

Yes! The Navy Federal Car Loan Calculator can estimate payments for both new loans and refinancing options.

Does the calculator include taxes and fees?

No, but you should manually add taxes and dealer fees to get a complete estimate.

Is there a fee to use the Navy Federal Car Loan Calculator?

No, it’s completely free to use for NFCU members and non-members.

5. What is the maximum loan term Navy Federal offers?

NFCU offers loan terms up to 96 months, depending on the vehicle and borrower eligibility. navy federal car loan calculator

Conclusion

The Navy Federal Car Loan Calculator is an essential tool for anyone considering an auto loan. By using it effectively, you can estimate monthly payments, compare loan options, and secure the best financing deal. Whether you’re buying a new or used car or refinancing, this calculator helps you make an informed decision. Start your car loan journey today by exploring Navy Federal’s financing options!

Hello! I hope you’re having a great day. Good luck 🙂

how to rank plz reply

Si eres fanatico de los juegos de azar en Espana, has llegado al portal correcto. En este sitio encontraras resenas actualizadas sobre los casinos mas confiables disponibles en Espana.

Ventajas de jugar en casinos de Espana

Plataformas seguras para jugar con seguridad garantizada.

Bonos de bienvenida exclusivos que aumentan tus posibilidades de ganar.

Slots, juegos de mesa y apuestas deportivas con premios atractivos.

Depositos y retiros sin problemas con multiples metodos de pago, incluyendo tarjetas, PayPal y criptomonedas.

?Donde encontrar los mejores casinos?

En nuestra guia hemos recopilado las opiniones de expertos sobre los mejores casinos en linea de Espana. Consulta la informacion aqui:

casinotorero.info

Abre tu cuenta en un casino confiable y vive la emocion de los mejores juegos.

give me order

Мощные светодиодные светильники для производственных помещений от производителя

уличные светодиодные светильники и прожектора https://proizvodstvo-svetodiodnih-svetilnikov.ru .

give me order

Как провести отпуск в Абхазии без лишних затрат

отдых в абхазии без посредников otdyhabhazia01.ru .