Managing debt is key to keeping your finances in good shape. Portfolio recovery helps you understand and tackle your debt. It’s a vital step in managing your finances well.

Debt can feel overwhelming, but you can manage it. Portfolio recovery means knowing your finances, making a debt plan, and avoiding future money troubles. Good debt management leads to better financial health.

A serene financial landscape comes into focus, symbolizing the journey of portfolio recovery. In the foreground, a person confidently navigates a path through a lush, verdant field, representing the regained control over their finances. The middle ground showcases a well-diversified investment portfolio, its components harmoniously arranged, conveying a sense of balance and stability. In the distance, a vibrant sunset paints the sky with warm hues, evoking a feeling of optimism and new beginnings. The scene is captured with a soft, dreamlike quality, as if viewed through the lens of a high-end mirrorless camera, emphasizing the tranquility and clarity of the moment.

By managing your finances through portfolio recovery, you can boost your financial health and feel less stressed. It’s important to understand your financial situation and have a solid plan to pay off your debt.

Key Takeaways

Portfolio recovery is a crucial step in managing debt and improving financial health.

Understanding your financial situation is essential for creating a plan to tackle debt.

festive debt management is key to achieving good financial health.

Portfolio recovery involves creating a plan to manage debt and taking steps to prevent future financial issues.

By taking control of your finances, you can improve your financial health and reduce stress. Portfolio Recovery

Debt management is a critical aspect of maintaining good financial health.

Understanding Portfolio Recovery Services

Portfolio recovery services are key in managing debt. They help people deal with the complex debt collection process. These services work with creditors to lower debt or set up easier payment plans.

Debt collection can feel overwhelming. But, with portfolio recovery services, you get support and guidance. Financial services like debt counseling and credit management also help manage debt and plan for the future.

A collection agent stands sternly, looming over a distressed individual cowering under a mountain of bills and statements. The agent’s gaze is unwavering, casting a long shadow that engulfs the scene. In the background, a blurred office environment conveys a sense of bureaucracy and the impersonal nature of the debt collection process. The lighting is harsh, creating stark contrasts and emphasizing the power imbalance between the two figures. The overall atmosphere is one of unease, pressure, and the overwhelming burden of financial obligations. Portfolio Recovery

Reduced debt amounts through negotiation with creditors

More manageable payment plans, making it easier to pay off debt

Guidance and support throughout the debt collection process

Access to financial services, such as debt counseling and credit management Portfolio Recovery

Knowing how portfolio recovery services work can help you manage your debt better. It’s a step towards financial stability and control.

The Impact of Debt Collection on Your Financial Health

Debt collection can really hurt your financial health, especially your credit score. When debts go to collection agencies, your credit score can drop a lot. This makes it tough to get loans or credit later on. It’s important to understand how debt collection affects your credit scores.

Your credit score is crucial for your financial health. A low score means you might not get credit or face higher interest rates. Debt collection can lower your score because it shows lenders you’re struggling with debt. Quick action on debt collection can help keep your credit score up and improve your finances.

When dealing with debt collection and its impact on your finances, consider these points: Portfolio Recovery

- Talk to collection agencies to settle debts

- Challenge any mistakes on your credit report

- Pay on time to boost your credit score

By following these steps, you can protect your financial health and aim for a better credit score.

Your Rights When Dealing with Portfolio Recovery

When you’re dealing with debt collectors, knowing your rights is key. The Fair Debt Collection Practices Act (FDCPA) protects you from unfair practices. Understanding these rights helps you deal with debt collectors fairly and respectfully.

Knowing your consumer rights is a big part of managing debt. It tells you how collectors can contact you and what they can’t do. Being informed helps you make better choices about your money. Portfolio Recovery

Some important rights include:

he right to be treated with respect and dignity

The right to dispute debts and have them verified

The right to stop debt collectors from contacting you

Understanding these rights helps you manage your debt better. It also protects you from unfair practices. Remember, consumer rights are there to help you make smart financial choices.

Creating Your Debt Management Strategy

Managing debt well is key. This is where credit repair and financial planning play a big role. Start by looking at your finances to make a plan that fits you. List all your debts, know the terms, and find ways to adjust your budget.

Financial planning is also crucial. It means making a budget that covers all your costs, income, and debt payments. By focusing on what you need over what you want, you can save more for debt repayment. Also, credit repair can boost your credit score, helping you get better loan terms in the future.

Track your income and expenses to understand where your money is going

Make a list of all debts, including balances, interest rates, and minimum payments

Prioritize debts, focusing on high-interest debts first

Consider debt consolidation or negotiation with creditors to simplify payments and reduce interest rates

By following these steps and using credit repair and financial planning, you can manage your debt better. This will improve your financial health over time.

Negotiating with Portfolio Recovery Associates

Dealing with debt collectors requires knowing your rights and being ready to negotiate. Negotiating with creditors can be tough, but there are ways to succeed. Understanding the debt and proposing better payment plans are key.

Knowing when to get help from credit counseling services is important for debt settlement. These services offer valuable advice and support. With a clear plan and understanding, you can reach a debt settlement that helps your finances.

Stay calm and professional during negotiations

Be transparent about your financial situation

propose alternative payment plans that are realistic and manageable

By following these tips and being ready to negotiate, you can improve your financial health. This is through effectivenegotiating with creditorsanddebt settlementstrategies.

Building a Strong Financial Foundation

Creating a strong financial foundation is key for long-term financial health. It involves financial planning and budgeting. This ensures all expenses, debts, and savings goals are covered. By focusing on needs over wants, people can tackle debt and build savings.

Using effective budgeting and saving strategies, like the 50/30/20 rule, helps achieve financial stability. This rule splits income into 50% for necessary expenses, 30% for discretionary spending, and 20% for saving and debt repayment. Following this rule helps make progress on financial goals.

Creating a realistic budget that accounts for all expenses and debts

Prioritizing needs over wants and allocating funds accordingly

Building an emergency fund to cover 3-6 months of living expenses

investing in a retirement account, such as a 401(k) or IRA

By following these tips and using financial planning and budgeting daily, individuals can reach financial stability. They can move from debt management to a position of financial strength.

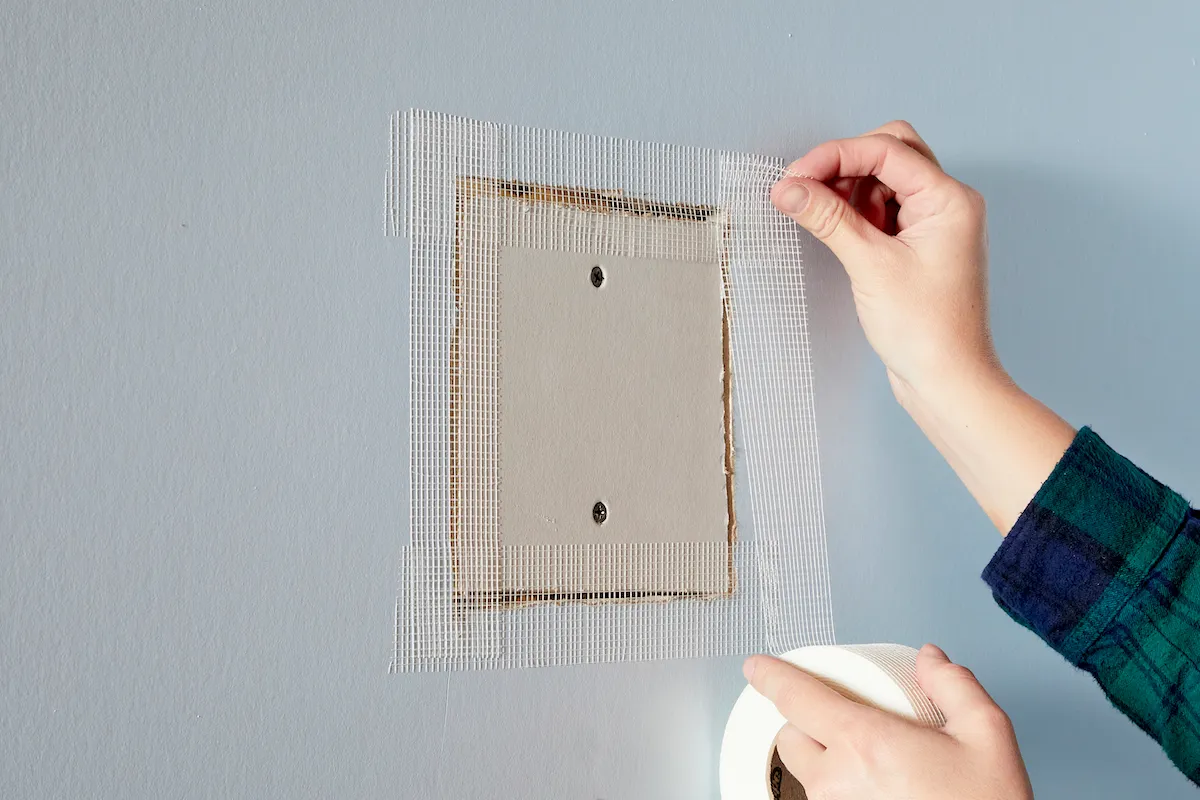

Steps to Verify Your Portfolio Recovery Debt

Verifying debt is key when dealing with portfolio recovery services. Consumers can ask for debt validation. This means the debt collector must show proof of the debt. It makes sure the debt is real and not a mistake.

Asking for debt validation is a big part of consumer protection. It helps consumers avoid scams and deal with real debts. To start, send a written request to the debt collector. Ask them to show you proof that the debt is yours.

Send a written request to the debt collector, asking for debt validation

Review the response carefully to ensure it includes all necessary documentation

Check for any discrepancies or errors in the documentation

Dispute the debt if you find any errors or discrepancies

By following these steps, consumers can protect their rights. Debt validation and consumer protection are vital in the debt collection process. It’s important for consumers to know their rights and what to do.

Rebuilding Your Credit After Collections

Rebuilding credit after collections needs a smart plan. It’s all about credit repair and boosting your credit score. By paying off the debt, making timely payments, and checking your credit reports, you can get better loan terms. This helps improve your financial health.

To begin credit repair, think about becoming an authorized user or getting a secured credit card. Regular payments on these accounts show you’re responsible with credit. Also, checking your credit reports for mistakes and fixing them ensures your score is fair.

Making all payments on time

Keeping credit utilization rates low

Monitoring credit reports for errors

Considering a secured credit card or becoming an authorized user on someone else’s credit account

By using these methods and focusing on credit repair and credit score improvement, you can start rebuilding your credit. This is the first step towards a stronger financial future.

Legal Options and Professional Help

Dealing with debt can be tough. It’s key to know the legal options and professional help out there. Getting legal assistance can offer the support and guidance needed to tackle complex debt situations. Debt management experts can craft a plan tailored to your needs, helping improve your financial health.

At times, talking to a bankruptcy attorney or a credit counseling agency is crucial. These experts can explain your rights and help you make smart choices about managing your debt. Knowing when to ask for legal assistance can protect your rights and help solve debt problems effectively.

Debt management professionals offer valuable advice on making a debt plan, talking to creditors, and fixing credit. Some benefits of their help include:

- Personalized debt management plans

- Expert guidance on negotiating with creditors

- Support in rebuilding credit

In the end, getting legal assistance and working with debt management professionals can give you the tools and support to take back control of your finances. This can lead to long-term financial stability.

Preventing Future Debt Problems

Effective financial planning is key to avoiding debt. By making a budget and sticking to it, you can avoid overspending. This ensures you have money for unexpected costs.

Regularly check your budget, avoid unnecessary debt, and save for emergencies. These steps help keep your finances stable.

Some important strategies for debt prevention include automating savings and avoiding lifestyle inflation. Always keep an eye on your credit reports. These actions help secure your financial future.

- Set financial goals and prioritize needs over wants

- Avoid impulse buys and credit card debt

- Build a safety net for 3-6 months of living expenses

Being proactive in financial planning and debt prevention lowers your debt risk. Stay informed about personal finance to make smart money choices.

Conclusion: Taking Control of Your Financial Future

As we wrap up this journey, let’s think about what we’ve learned. You now know how debt collection works and how to stand up for yourself. You’ve also learned how to make a debt plan and talk to Portfolio Recovery Associates.

Getting out of debt won’t happen overnight, but it’s possible with hard work and the right attitude. You can fix your credit and look into legal ways to deal with debt. This will help you build a strong financial base.

It’s up to you to control your financial future. Use what you’ve learned to start moving towards a debt-free life. With the right steps and a focus on your finances, you can achieve financial freedom. This will lead to a brighter and more prosperous future.

FAQ

What is portfolio recovery and how can it help me regain control of my finances?

Portfolio recovery helps you manage your debt and improve your finances. It starts with understanding your current financial situation. Then, you create a plan to tackle your debt and prevent future financial problems.

By using portfolio recovery services, you can handle debt collection. This helps you work towards becoming debt-free.

How do portfolio recovery services operate and what are their benefits?

Portfolio recovery services help you manage and pay off debt. They often negotiate with creditors to reduce debt or create easier payment plans. Knowing how these services work is key to making good debt management decisions.

Using these services can help you deal with debt collection. This way, you can move towards a more stable financial future.

How does debt collection impact my credit score and overall financial health?

Debt collection can hurt your financial health, especially your credit score. When debts are sent to collection agencies, your credit score can drop a lot. This makes it harder to get loans or credit later.

Understanding how debt collection affects your credit score is important. By addressing debt collection issues quickly, you can lessen the damage to your credit score. This helps improve your overall financial situation.

What are my rights when dealing with portfolio recovery and debt collection?

Knowing your rights is crucial when dealing with debt collection. The Fair Debt Collection Practices Act (FDCPA) protects you from unfair debt collection practices. Knowing your rights helps you deal with debt collectors fairly.

Being informed lets you assert your rights. This way, you can make better decisions about managing your debt.

How can I create an effective debt management strategy?

Creating a debt management strategy starts with assessing your financial situation. List all your debts and understand each one’s terms. Then, find ways to adjust your budget.

With this info, you can make a plan to tackle your debt. This could include debt consolidation or negotiating with creditors. Good financial planning and credit repair are essential for managing your debt and improving your financial health.

What strategies can I use when negotiating with portfolio recovery associates?

Negotiating with debt collectors can be tough, but there are ways to succeed. Know your rights, understand the debt, and have a plan for alternative payment plans. Seeking professional help, like credit counseling, can also be beneficial.

Approach negotiations with a clear understanding of the situation. This way, you can aim for a debt settlement that’s good for your finances.

How can I verify the portfolio recovery debt I’m being asked to pay?

Verifying debt is a key step when dealing with debt collectors. You have the right to request debt validation. This means the collector must prove the debt is real.

Understanding how to verify debt and request validation is important. It helps protect you from scams and ensures you’re dealing with legitimate debts. This keeps your finances safe.

What are the legal options and professional help available for managing my debt?

Sometimes, you may need legal advice or professional help to manage your debt. This could mean talking to a bankruptcy attorney or working with a credit counseling agency. Knowing when to seek help is important.